When I was an audit freshman, my least favorite task was to prepare the income tax reconciliation. I frankly hated it.

The main reason was that I did not understand the purpose of it. For me, it seemed like a bunch of numbers and percentages that never add up and the magic table never gets balanced.

Our clients hated it too, especially if their transactions were complex, or there was a change in the tax rate or whatever happened.

Let me tell you my own story about the tax reconciliations. Sure, if not interested, then skip it and go straight to theory and example below.

Many years ago I was assigned to an audit team lead by very competent, but strict audit senior. Let’s call her Jess (not her real name!).

Jess was very hard working, clever and pedantic senior. Her working papers just looked great – all clean and neat. It was big pleasure to review them.

However, she was moody, vague, unpredictable and sometimes very unpleasant. She literally loved some audit assistants and praised them a lot and on the other hand, she could really dislike the other assistants and make their lives difficult.

You could never know in which category you were.

I was unlucky to end up in the second category. I have no idea why.

To this day, when we occasionally meet, we could barely look at each other and I even gave up greeting her, because she just never responded and looked straight through me like I was the air.

So, when I learned I would be in her audit team in a big manufacturing company with even bigger mess in the books, I instantly knew what would happen. And yes, it happened.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

I was swamped in the worst and nastiest tasks you could ever imagine. I had to attend the inventory count in the cold freezing midnight of the New Years Eve (no dancing and having fun that year!). And yes, you guessed it – I had to check the client’s tax reconciliation and propose corrections.

That was the exercise! Worse than the stock count, believe me.

I understood one point: if I don’t make it right, Jess would give me very bad feedback and it can have bad impact on my future career in that company. After all – that was her goal.

Speaking in a really vulgar slang (please pardon me), I was working my butt off. I worked so hard to understand the tax reconciliation and to make it right for the client, but after the whole night staring at the worksheets, it was done – to the big surprise and dislike of Jess.

Having that said, I am grateful to Jess for assigning me the most challenging tasks, because she helped me grow. Yes, that was not her main intention, but in this case, it was better to get as many benefits out of this situation, instead of giving up.

You know the old saying – when life gives you lemons, make lemonade.

Why did I tell you the story?

The reason is that based on my own experience I realized I could have saved a lot of time, if I would have taken the right sources of information and the right approach for tackling the tax reconciliation.

In this article, I’d like you to learn from my mistake, learn the right approach on the example and save the sleepless night ☺

The standard IAS 12 Income Taxes requires many disclosures, including the tax reconciliation.

It is the explanation of the relationship between the tax expense (income) and your accounting profit.

What’s the meaning of that?

Theoretically, you could calculate the tax expense as your accounting profit before tax multiplied with the tax rate applicable in your country.

In reality it does not work this way due to many different things, for example:

Due to these differences you have to explain why your income tax expense is NOT equal to the accounting profit multiplied with the tax rate.

The standard IAS 12 gives you the 2 options:

Maybe it looks simple and easy and indeed it is in many cases.

Sometimes, the company has too many transactions with temporary differences that it’s really hard to prepare.

To illustrate it, let me show you the numerical example with a few tips on how to proceed.

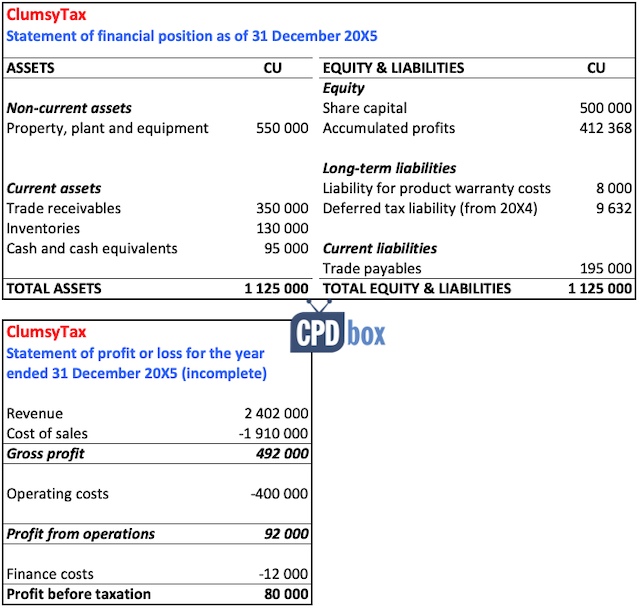

ClumsyTax is a manufacturing company preparing its tax information for the year ended 31 December 20X5. You have the following information:

Calculate current tax expense, deferred tax expense and prepare the tax reconciliation.

This example is a bit more complex, because you need to understand the tax reconciliation in the context of the financial statements, tax returns and other information.

It would not be very wise to show you purely this aspect without showing the full picture.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

So, before any attempts to work on tax reconciliation, make sure you have the following information ready:

Without having these 5 papers or worksheets in your hands, don’t waste your time and don’t start working on the tax reconciliation.

We have n. 1 and n.2 in our hands, but we don’t have tax return and deferred tax calculations.

Let’s prepare the tax return first.

| Description | CU at 31/12/20X5 |

| Accounting profit (A) | 80 000 |

| Add back: | |

| Accounting depreciation | 85 000 |

| Provision for warranty costs (20X5) | 2 500 |

| Promotion expenses | 900 |

| Add back – total (B) | 88 400 |

| Deduct: | |

| Tax depreciation | -103 000 |

| Warranty claims paid | -3 100 |

| Item | Carrying amount (A) | Tax base (B) | Temporary difference (C=A-B) | Deferred tax (-30%*C) |

| PPE | 550 000 | 489 000 | 61 000 | -18 300 |

| Trade receivables | 350 000 | 350 000 | 0 | 0 |

| Inventories | 130 000 | 130 000 | 0 | 0 |

| Cash & cash equivalents | 90 000 | 90 000 | 0 | 0 |

| Warranty cost liability | -8 000 | 0 | -8 000 | 2 400 |

| Trade payables | -195 000 | -195 000 | 0 | 0 |

| Total | -15 900 |

| Item | Carrying amount (A) | Tax base (B) | Temporary difference (C=A-B) | Deferred tax (-28%*C) |

| PPE | 635 000 | 592 000 | 43 000 | -12 040 |

| Warranty cost liability | -8 600 | 0 | -8 600 | 2 408 |

| Total | -9 632 |

The total tax expense consists of:

Total income tax expense in 20X5 = CU 18 690 + CU 6 268 = CU 24 958.

The deferred income tax expense is calculated as a difference between:

Anyway, this is very important: It is necessary to understand how that deferred tax expense arose, just in case your tax reconciliation does not balance:

| Item | CU |

| Deferred tax expense related to PPE | 5 400 |

| Deferred tax expense related to warranty cost liability | 180 |

| Increase in DTL resulting from the increase in the tax rate | 688 |

| Total deferred tax expense | 6 268 |

Where did I get these numbers?

We are almost done!

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

The only thing is to explain the relationship between:

I’ve done that in the following table:

| Item | CU |

| Accounting profit | 80 000 |

| Tax at the applicable rate of 30% | 24 000 |

| Tax effect of non-deductible promotional expenses (CU 900*30%) | 270 |

| Increase in DTL resulting from the increase in the tax rate (in step 2 above) | 688 |

| Total income tax expense | 24 958 |

Good piece of advice:

If your tax reconciliation does not make any sense, go back your current income tax calculation and make sure that you included all items either in the deferred tax calculation or added them as your outstanding items here in the reconciliation (such as promotional expenses for which no deferred tax was recognized).

Alternatively, we can explain the relationship between:

I’ve done that here:

| Item | % |

| Applicable tax rate | 30.00 |

| Tax effect of promotion expenses (270/80 000) | 0.34 |

| Tax effect of increase in DTL from the increase in the tax rate (688/80 000) | 0.86 |

| Average effective rate (same as 24 958/80 000) | 31.20 |

Phew, that was an exercise!

It was very simple, but you can still see that there’s a lot of work in it and you can’t do it isolated from other things – you must prepare all your tax calculation while seeing the full picture and relationships.

My own experience tells me that the biggest troubles arise exactly in the deferred tax part.

Make sure that you have the clear deferred tax calculations from the current year and from the previous year and compare them with the current income tax return.

If you are sure that the reversals of temporary differences were correctly recognized in both your tax return and your books, then you’re on the best way to succeed.