- The child had gross income of $4,300 or more;

- The child filed a joint return, or

- You could be claimed as a dependent on someone else’s return.

If the child isn’t claimed as your dependent, enter the child’s name in the entry space under the “Qualifying widow(er)” filing status.

Which Form To Use

Beginning in tax year 2019, Short Form 540NR, has been eliminated. Use Form 540NR if either you or your spouse/RDP were a nonresident or part-year resident in tax year 2021.

If you and your spouse/RDP were California residents during the entire tax year 2021, use Forms 540, California Resident Income Tax Return, or 540 2EZ, California Resident Income Tax Return. To download or order the 540 Personal Income Tax Booklet or the 540 2EZ Personal Income Tax Booklet, go to ftb.ca.gov/forms or see “Where to Get Income Tax Forms and Publications.”

What’s New and Other Important Information for 2021

Differences between California and Federal Law

In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2015. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. For more information, go to ftb.ca.gov and search for conformity. Additional information can be found in FTB Pub. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA (540NR), California Adjustments – Nonresidents or Part-Year Residents, and the Business Entity tax booklets.

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. We include information that is most useful to the greatest number of taxpayers in the limited space available. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. Taxpayers should not consider the instructions as authoritative law.

Conformity – For updates regarding federal acts, go to ftb.ca.gov and search for conformity.

2021 Tax Law Changes/What’s New

Voluntary Contributions – You may contribute to the following new funds:

- Mental Health Crisis Prevention Voluntary Tax Contribution Fund

- California Community and Neighborhood Tree Voluntary Tax Contribution Fund

COBRA Premium Assistance – The American Rescue Plan Act (ARPA) of 2021, enacted on March 11, 2021, allows an exclusion from gross income for COBRA premium assistance subsidies received by eligible individuals for the COBRA coverage period beginning on April 1, 2021 and ending on September 30, 2021. California law does not conform to this federal provision. For more information, see Schedule CA (540NR) instructions.

Employer-Provided Dependent Care Assistance Exclusion – California conforms to the employer-provided dependent care assistance exclusion from gross income as of the specified date of January 1, 2015, without any modifications. The ARPA of 2021, enacted on March 11, 2021, temporarily increases the amount of the exclusion from gross income from $5,000 to $10,500 (and half of that amount for married filing separate) for employer-provided dependent care assistance. CA law does not conform to this change under the federal ARPA. For more information, see Schedule CA (540NR) instructions.

Expanded Definition of Qualified Higher Education Expenses – For taxable years beginning on or after January 1, 2021, California law conforms to the expanded definition of qualified higher education expenses associated with participation in a registered apprenticeship program and payment on the principal or interest of a qualified education loan under the federal Further Consolidated Appropriations Act, 2020.

Federal Acts – In general, R&TC does not conform to the changes under the following federal acts. California taxpayers continue to follow the IRC as of the specified date of January 1, 2015, with modifications. For specific adjustments due to the following acts, see the Schedule CA (540NR) instructions.

- American Rescue Plan Act (ARPA) of 2021 (enacted on March 11, 2021)

- Consolidated Appropriations Act (CAA), 2021 (enacted on December 27, 2020)

- Coronavirus Aid, Relief, and Economic Security (CARES) Act (enacted on March 27, 2020)

- Setting Every Community Up for Retirement Enhancement (SECURE) Act (enacted on December 20, 2019)

California Microbusiness COVID-19 Relief Grant – For taxable years beginning on or after January 1, 2020, and before January 1, 2023, California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the California Microbusiness COVID-19 Relief Program that is administered by the Office of Small Business Advocate (CalOSBA). For more information, see R&TC Section 17158.1 and Schedule CA (540NR) instructions.

Shuttered Venue Operator Grant – For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for amounts awarded as a shuttered venue operator grant under the CAA, 2021. The CAA, 2021, allows deductions for eligible expenses paid for with grant amounts. California law conforms to this federal provision, with modifications. For California purposes, these deductions do not apply to an ineligible entity. "Ineligible entity" means a taxpayer that is either a publicly-traded company or does not meet the 25% reduction from gross receipts requirements under Section 311 of Division N of the CAA, 2021. For more information, see R&TC Section 17158.3 and Schedule CA (540NR) instructions.

California Venues Grant – For taxable years beginning on or after September 1, 2020, and before January 1, 2030, California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the California Venues Grant Program that is administered by CalOSBA. For more information, see R&TC Section 17158 and Schedule CA (540NR) instructions.

Small Business COVID-19 Relief Grant Program – For taxable years beginning on or after January 1, 2020, and before January 1, 2030, California allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the COVID-19 Relief Grant under Executive Order No.E 20/21-182 and the California Small Business COVID-19 Relief Grant Program established by Section 12100.83 of the Government Code. For more information, see Schedule CA (540NR) instructions.

Income Exclusion for Rent Forgiveness – For taxable years beginning on or after January 1, 2020, and before January 1, 2025, gross income shall not include a tenant’s rent liability that is forgiven by a landlord or rent forgiveness provided through funds grantees received as a direct allocation from the Secretary of the Treasury based on the federal CAA, 2021. For more information, see Schedule CA (540NR) instructions.

Paycheck Protection Program (PPP) Loans Forgiveness – For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for covered loan amounts forgiven under the federal CARES Act, Paycheck Protection Program and Health Care Enhancement Act, Paycheck Protection Program Flexibility Act of 2020, the CAA, 2021, or the PPP Extension Act of 2021.

Also, the ARPA expands PPP eligibility to include “additional covered nonprofit entities” which includes certain Code 501(c) nonprofit organizations and Internet-only news publishers and Internet-only periodical publishers. California law does not conform to this expansion of PPP eligibility. For more information, see Schedule CA (540NR) instructions.

The CAA, 2021, allows deductions for eligible expenses paid for with covered loan amounts. California law conforms to this federal provision, with modifications. For California purposes, these deductions do not apply to an ineligible entity. “Ineligible entity” means a taxpayer that is either a publicly-traded company or does not meet the 25% reduction from gross receipts requirements under Section 311 of Division N of the CAA, 2021. For more information, see Schedule CA (540NR) instructions or R&TC Section 17131.8 or go to ftb.ca.gov and search for AB 80.

Revenue Procedure 2021-20 allows taxpayers to make an election to report the eligible expense deductions related to a PPP loan on a timely filed original 2021 tax return including extensions. If a taxpayer makes an election for federal purposes, California will follow the federal treatment for California tax purposes.

Advance Grant Amount – For taxable years beginning on or after January 1, 2019, California law conforms to the federal law regarding the treatment for an emergency Economic Injury Disaster Loan (EIDL) grant under the federal CARES Act or a targeted EIDL advance under the CAA, 2021.

Other Loan Forgiveness – For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for borrowers of forgiveness of indebtedness described in Section 1109(d)(2)(D) of the federal CARES Act as stated by section 278, Division N of the federal CAA, 2021. The CAA, 2021, allows deductions for eligible expenses paid for with covered loan amounts. California law conforms to this federal provision, with modifications. For California purposes, these deductions generally do not apply to an ineligible entity. “Ineligible entity” means a taxpayer that is either a publicly-traded company or does not meet the 25% reduction from gross receipts requirements under Section 311 of the CAA, 2021. For more information, see Schedule CA (540NR) instructions or go to ftb.ca.gov and search for AB 80.

Gross Income Exclusion for Bruce’s Beach – Effective September 30, 2021, California law allows an exclusion from gross income for the first time sale in the taxable year in which the land within Manhattan State Beach, known as “Peck’s Manhattan Beach Tract Block 5” and commonly referred to as “Bruce’s Beach” is sold, transferred, or encumbered. A recipient’s gross income does not include the following:

- Any sale, transfer, or encumbrance of Bruce’s Beach;

- Any gain, income, or proceeds received that is directly derived from the sale, transfer, or encumbrance of Bruce’s Beach.

For more information, get Schedule D (540NR), California Capital Gain or Loss Adjustment.

Reporting Requirements – For taxable years beginning on or after January 1, 2021, taxpayers who benefited from the exclusion from gross income for the PPP loans forgiveness, other loan forgiveness, the EIDL advance grant, restaurant revitalization grant, or shuttered venue operator grant, and related eligible expense deductions under the federal CARES Act, Paycheck Protection Program and Health Care Enhancement Act, Paycheck Protection Program Flexibility Act of 2020, the ARPA of 2021, the CAA, 2021, or the PPP Extension Act of 2021, should file form FTB 4197, Information on Tax Expenditure Items, as part of the FTB's annual reporting requirement. For more information, get form FTB 4197.

Moving Expense Deduction – For taxable years beginning on or after January 1, 2021, taxpayers should file California form FTB 3913, Moving Expense Deduction, to claim moving expense deductions. Attach the completed form FTB 3913 to Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. For more information, see Schedule CA (540NR) instructions and get form FTB 3913.

Homeless Hiring Tax Credit – For taxable years beginning on or after January 1, 2022, and before January 1, 2027, a Homeless Hiring Tax Credit (HHTC) will be available to a qualified taxpayer that hires individuals who are, or recently were, homeless. The amount of the tax credit will be based on the number of hours the employee works in the taxable year. Employers must obtain a certification of the individual’s homeless status from an organization that works with the homeless and must receive a tentative credit reservation for that employee. Any credits not used in the taxable year may be carried forward up to three years. For more information, go to ftb.ca.gov and search for hhtc.

Elective Tax for Pass-Through Entities (PTE) and Credit for Owners – For taxable years beginning on or after January 1, 2021, and before January 1, 2026, California law allows an entity taxed as a partnership or an “S” corporation to annually elect to pay an elective tax at a rate of 9.3 percent based on its qualified net income. The election shall be made on an original, timely filed return and is irrevocable for the taxable year.

The law allows a credit against the personal income tax to a taxpayer, other than a partnership, that is a partner, shareholder, or member of a qualified entity that elects to pay the elective tax, in an amount equal to 9.3 percent of the partner’s, shareholder’s, or member’s pro rata share or distributive share and guaranteed payments of qualified net income subject to the election made by the qualified entity. A disregarded business entity and its partners or members cannot claim the credit, except for a disregarded single member limited liability company (SMLLC) that is owned by an individual, fiduciary, estate, or trust subject to personal income tax. For more information, go to ftb.ca.gov and search for pte elective tax and get the following new PTE elective tax forms and instructions:

- Form FTB 3893, Pass-Through Entity Elective Tax Payment Voucher

- Form FTB 3804, Pass-Through Entity Elective Tax Calculation

- Form FTB 3804-CR, Pass-Through Entity Elective Tax Credit

Main Street Small Business Tax Credit II – For the taxable year beginning on or after January 1, 2021, and before January 1, 2022, a new Main Street Small Business Tax Credit is available to a qualified small business employer that received a tentative credit reservation from the California Department of Tax and Fee Administration (CDTFA). For more information, get form FTB 3866, Main Street Small Business Tax Credits.

New Donated Fresh Fruits or Vegetables Credit – The sunset date for the New Donated Fresh Fruits or Vegetables Credit is extended until taxable years beginning before January 1, 2027. For more information, get form FTB 3814, New Donated Fresh Fruits or Vegetables Credit.

Natural Heritage Preservation Credit – The Natural Heritage Preservation Credit is available for qualified contributions made on or after January 1, 2021, and no later than June 30, 2026. This credit may not be claimed for any contributions made on or after July 1, 2020, and on or before December 31, 2020. For more information, get form FTB 3503, Natural Heritage Preservation Credit.

Other Important Information

Dependent Exemption Credit with No ID – For taxable years beginning on or after January 1, 2018, taxpayers claiming a dependent exemption credit for a dependent who is ineligible for a Social Security Number (SSN) and a federal Individual Taxpayer Identification Number (ITIN) may provide alternative information to the FTB to identify the dependent. To claim the dependent exemption credit, taxpayers complete form FTB 3568, Alternative Identifying Information for the Dependent Exemption Credit, attach the form and required documentation to their tax return, and write “no id” in the SSN field of line 10, Dependents, on Form 540NR. For each dependent being claimed that does not have an SSN and an ITIN, a form FTB 3568 must be provided along with supporting documentation.

Taxpayers may amend their tax return beginning with taxable year 2018 to claim the dependent exemption credit. For more information on how to amend your tax returns, see “Instructions for Filing a 2021 Amended Return.”

CARES Act Qualified Employer Plan Loans – For taxable years beginning on or after January 1, 2020, California conforms to the qualified employer plan loans provision under the federal CARES Act which temporarily increases the amount of loans allowable from a qualified employer plan to $100,000 for coronavirus-related relief and delays by one year the due date for any repayment for an outstanding loan from a qualified employer plan if requirements are met.

Expansion for Credits Eligibility – For taxable years beginning on or after January 1, 2020, California expanded EITC and YCTC eligibility to allow either the federal ITIN or the SSN to be used by all eligible individuals, their spouses, and qualifying children. If an ITIN is used, eligible individuals should provide identifying documents upon request of the FTB. Any valid SSN can be used, not only those that are valid for work. Additionally, upon receiving a valid SSN, the individual should notify the FTB in the time and manner prescribed by the FTB. The YCTC is available if the eligible individual or spouse has a qualifying child younger than six years old. For more information, go to ftb.ca.gov and search for eitc, or get form FTB 3514.

Worker Status: Employees and Independent Contractors – Some individuals may be classified as independent contractors for federal purposes and employees for California purposes, which may also cause changes in how their income and deductions are classified. Proposition 22 was operative as of December 16, 2020 and may affect a taxpayer’s worker classification. For more information, see the instructions for Schedule CA (540NR).

Minimum Essential Coverage Individual Mandate – For taxable years beginning on or after January 1, 2020, California law requires residents and their dependents to obtain and maintain minimum essential coverage (MEC), also referred to as qualifying health care coverage. Individuals who fail to maintain qualifying health care coverage for any month during the taxable year will be subject to a penalty unless they qualify for an exemption. For more information, see specific line instructions for Form 540NR, lines 74, 87, and 91, or get the following health care forms, instructions, and publications:

- Form FTB 3849, Premium Assistance Subsidy

- Form FTB 3853, Health Coverage Exemptions and Individual Shared Responsibility Penalty

- Form FTB 3895, California Health Insurance Marketplace Statement

- Publication 3849A, Premium Assistance Subsidy (PAS)

- Publication 3895B, California Instructions for Filing Federal Forms 1094-B and 1095-B

- Publication 3895C, California Instructions for Filing Federal Forms 1094-C and 1095-C

Rental Real Estate Activities – For taxable years beginning on or after January 1, 2020, the dollar limitation for the offset for rental real estate activities shall not apply to the low income housing credit program. For more information, see R&TC Section 17561(d)(1). Get form FTB 3801-CR, Passive Activity Credit Limitations, for more information.

R&TC Section 41 Reporting Requirements – Beginning in taxable year 2020, California allows individuals and other taxpayers operating under the personal income tax law to claim credits and deductions of business expenses paid or incurred during the taxable year in conducting commercial cannabis activity. Sole proprietors conducting a commercial cannabis activity that is licensed under California Medicinal and Adult-Use Cannabis Regulation and Safety Act should file form FTB 4197. The FTB uses information from form FTB 4197 for reports required by the California Legislature. Get form FTB 4197 for more information.

Net Operating Loss Suspension – For taxable years beginning on or after January 1, 2020, and before January 1, 2023, California has suspended the net operating loss (NOL) carryover deduction. Taxpayers may continue to compute and carryover an NOL during the suspension period. However, taxpayers with net business income or modified adjusted gross income of less than $1,000,000 or with disaster loss carryovers are not affected by the NOL suspension rules.

The carryover period for suspended losses is extended by:

- Three years for losses incurred in taxable years beginning before January 1, 2020.

- Two years for losses incurred in taxable years beginning on or after January 1, 2020, and before January 1, 2021.

- One year for losses incurred in taxable years beginning on or after January 1, 2021, and before January 1, 2022.

For more information, see R&TC Section 17276.23, and get form FTB 3805V, Net Operating Loss (NOL) Computation and NOL and Disaster Loss Limitations – Individuals, Estates, and Trusts.

Excess Business Loss Limitation – The federal CARES Act made amendments to IRC Section 461(l) by eliminating the excess business loss limitation of noncorporate taxpayers for taxable year 2020 and retroactively removing the limitation for taxable years 2018 and 2019. California does not conform to those amendments. Also, California law does not conform to the federal changes in the ARPA that extends the limitation on excess business losses of noncorporate taxpayers for taxable years beginning after December 31, 2020 and ending before January 1, 2027. Complete form FTB 3461, California Limitation on Business Losses, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $262,000 ($524,000 for married taxpayers filing a joint return). For more information, get form FTB 3461 and the instructions for Schedule CA (540NR).

Program 3.0 California Motion Picture and Television Production Credit – For taxable years beginning on or after January 1, 2020, California R&TC Section 17053.98 allows a third film credit, program 3.0, against tax. The credit is allocated and certified by the California Film Commission (CFC). The qualified taxpayer can:

- Offset the credit against income tax liability.

- Sell the credit to an unrelated party (independent films only).

- Assign the credit to an affiliated corporation.

- Apply the credit against qualified sales and use taxes.

For more information, get form FTB 3541, California Motion Picture and Television Production Credit, form FTB 3551, Sale of Credit Attributable to an Independent Film, go to ftb.ca.gov and search for motion picture, or go to the CFC website at film.ca.gov and search for incentives.

Business Credit Limitation – For taxable years beginning on or after January 1, 2020, and before January 1, 2023, there is a $5,000,000 limitation on the application of business credits for taxpayers. The total of all business credits including the carryover of any business credit for the taxable year may not reduce the “net tax” by more than $5,000,000. Business credits should be applied against “net tax” before other credits. Business credits disallowed due to the limitation may be carried over. The carryover period for disallowed credits is extended by the number of taxable years the credit was not allowed. For more information, get Schedule P (540NR), Alternative Minimum Tax and Credit Limitations – Nonresidents or Part-Year Residents.

Loophole Closure and Small Business and Working Families Tax Relief Act of 2019 – The Tax Cuts and Jobs Act (TCJA) signed into law on December 22, 2017, made changes to the IRC. California R&TC does not conform to all of the changes. In general, for taxable years beginning on or after January 1, 2019, California conforms to the following TCJA provisions:

- California Achieving a Better Life Experience (ABLE) Program

- Student loan discharged on account of death or disability

- Federal Deposit Insurance Corporation (FDIC) Premiums

- Excess employee compensation

- Excess business loss

Like-Kind Exchanges – The TCJA amended IRC Section 1031 limiting the nonrecognition of gain or loss on like-kind exchanges to real property held for productive use or investment. California conforms to this change under the TCJA for exchanges initiated after January 10, 2019. However, for California purposes, with regard to individuals, this limitation only applies to:

- A taxpayer who is a head of household, a surviving spouse, or spouse filing a joint return with adjusted gross income (AGI) of $500,000 or more for the taxable year in which the exchange begins.

- Any other taxpayer filing an individual return with AGI of $250,000 or more for the taxable year in which the exchange begins.

Get Schedule D-1, Sales of Business Property, for more information.

California requires taxpayers who exchange property located in California for like‑kind property located outside of California under IRC Section 1031, to file an annual information return with the FTB. For more information, get form FTB 3840, California Like‑Kind Exchanges, or go to ftb.ca.gov and search for like kind.

Young Child Tax Credit – For taxable years beginning on or after January 1, 2019, the refundable YCTC is available to taxpayers who also qualify for the California EITC and who have at least one qualifying child who is younger than six years old as of the last day of the taxable year. The maximum amount of credit allowable for a qualified taxpayer is $1,000. The credit amount phases out as earned income exceeds the threshold amount of $25,000, and completely phases out at $30,000. For more information, see specific line instructions for Form 540NR, line 86 and get form FTB 3514.

Net Operating Loss Carrybacks – For taxable years beginning on or after January 1, 2019, net operating loss carrybacks are not allowed.

Alimony – California law does not conform to changes made by the TCJA to federal law regarding alimony and separate maintenance payments that are not deductible by the payor spouse, and are not includable in the income of the receiving spouse, if made under any divorce or separation agreement executed after December 31, 2018, or executed on or before December 31, 2018, and modified after that date (if the modification expressly provides that the amendments apply). See Schedule CA (540NR) specific line instructions for more information.

Small Business Accounting/Percentage of Completion Method – For taxable years beginning on or after January 1, 2019, California law generally conforms to the TCJA’s definition of small businesses as taxpayers whose average annual gross receipts over three years do not exceed $25 million. These small businesses are exempt from the requirement of using the Percentage of Completion Method of accounting for any construction contract if the contract is estimated to be completed within two years from the date the contract was entered into. A taxpayer may elect to apply the provision regarding accounting for long term contracts to contracts entered into on or after January 1, 2018.

Student Loan Discharged Due to Closure of a For-Profit School – California law allows an income exclusion for an eligible individual who is granted a discharge of any student loan under specified conditions. This income exclusion has now been expanded to include a discharge of student loans occurring on or after January 1, 2019, and before January 1, 2024, for individuals who attended a Brightwood College school or a location of The Art Institute of California. Additional information can be found in the instructions for California Schedule CA (540NR).

Charitable Contribution and Business Expense Deductions Disallowance – For taxable years beginning on or after January 1, 2014, California law disallows a charitable contribution deduction to an educational organization that is a postsecondary institution or to the Key Worldwide Foundation, and a deduction for a business expense related to a payment to the Edge College and Career Network, LLC, to a taxpayer who meets specific conditions, including that they are named in any of several specified criminal complaints. For taxable years beginning on or after 2014, file an amended Form 540NR and Schedule X, California Explanation of Amended Return Changes, to report the correct amount of charitable contribution and business expense deductions, as applicable. Additional information can be found in the instructions of California Schedule CA (540NR).

Real Estate Withholding Statement – Effective January 1, 2020, the real estate withholding forms and instructions have been consolidated into one new Form 593, Real Estate Withholding Statement. For more information, get Form 593.

California Earned Income Tax Credit – For taxable years beginning on or after January 1, 2018, the age limit for an eligible individual without a qualifying child is revised to 18 years or older. For more information, go to ftb.ca.gov and search for eitc or get form FTB 3514.

Native American Earned Income Exemption – For taxable years beginning on or after January 1, 2018, federally recognized tribal members living in California Indian country who earn income from any federally recognized California Indian country are exempt from California taxation. This exemption applies only to earned income. Enrolled tribal members who receive per capita income must reside in their affiliated tribe’s Indian country to qualify for tax exempt status. Additional information can be found in the instructions for Schedule CA (540NR) and form FTB 3504, Enrolled Tribal Member Certification.

IRC Section 965 Deferred Foreign Income – Under federal law, if you own (directly or indirectly) certain foreign corporations, you may have to include on your return certain deferred foreign income. California does not conform. For more information, see the Schedule CA (540NR) instructions.

Global Intangible Low-Taxed Income (GILTI) Under IRC Section 951A – Under federal law, if you are a U.S. shareholder of a controlled foreign corporation, you must include your GILTI in your income. California does not conform. For more information, see the Schedule CA (540NR) instructions.

Wrongful Incarceration Exclusion – California law conforms to federal law excluding from gross income certain amounts received by wrongfully incarcerated individuals for taxable years beginning before, on, or after January 1, 2018. If you included income for wrongful incarceration in a prior taxable year, you can file an amended California personal income tax return for that year. If the normal statute of limitations has expired, you must file a claim by January 1, 2019.

College Access Tax Credit – For taxable years beginning on and after January 1, 2017, and before January 1, 2023, the College Access Tax Credit (CATC) is available to entities awarded the credit from the California Educational Facilities Authority (CEFA). The credit is 50% of the amount contributed by the taxpayer for the taxable year to the College Access Tax Credit Fund. The amount of the credit is allocated and certified by the CEFA. For more information, go to the CEFA website at treasurer.ca.gov and search for catc.

Schedule X, California Explanation of Amended Return Changes – For taxable years beginning on or after January 1, 2017, use Schedule X to determine any additional amount you owe or refund due to you, and to provide reason(s) for amending your previously filed income tax return. For additional information, see “Instructions for Filing a 2021 Amended Return.”

Improper Withholding on Severance Paid to Veterans – The Combat-Injured Veterans Tax Fairness Act of 2016 gives veterans who retired from the Armed Forces for medical reasons additional time to claim a refund if they had taxes improperly withheld from their severance pay. If you filed an amended return with the IRS on this issue, you have two years to file your amended California return.

California Achieving a Better Life Experience (ABLE) Program – For taxable years beginning on or after January 1, 2016, the California Qualified ABLE Program was established and California generally conforms to the federal income tax treatment of ABLE accounts. This program was established to help blind or disabled U.S. residents save money in a tax-favored ABLE account to maintain health, independence, and quality of life. Additional information can be found in the instructions of form FTB 3805P, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts.

Electronic Funds Withdrawal (EFW) – Make extension or estimated tax payments using tax preparation software. Check with your software provider to determine if they support EFW for extension or estimated tax payments.

Payments and Credits Applied to Use Tax – For taxable years beginning on or after January 1, 2015, if a taxpayer includes use tax on their personal income tax return, payments and credits will be applied to use tax first, then towards income tax, interest, and penalties. Additional information can be found in the instructions for California Form 540.

Dependent Social Security Number – Taxpayers claiming an exemption credit must write each dependent’s SSN in the spaces provided within line 10 for California Form 540NR. If you are claiming an exemption credit for a dependent who is ineligible for an SSN and a federal ITIN, you may complete and provide form FTB 3568 with required documentation attached to the tax return and write "no id" in the SSN field of line 10. For more information, see Form 540NR specific instructions for line 10 and get FTB 3568.

Financial Incentive for Seismic Improvement – Taxpayers can exclude from gross income any amount received as loan forgiveness, grant, credit, rebate, voucher, or other financial incentive issued by the California Residential Mitigation Program or the California Earthquake Authority to assist a residential property owner or occupant with expenses paid, or obligations incurred, for earthquake loss mitigation. Additional information can be found in the instructions for California Schedule CA (540NR).

Disaster Losses – For taxable years beginning on or after January 1, 2014, and before January 1, 2024, taxpayers may deduct a disaster loss for any loss sustained in any city, county, or city and county in California that is proclaimed by the Governor to be in a state of emergency. For these Governor-only declared disasters, subsequent state legislation is not required to activate the disaster loss provisions. Additional information can be found in the instructions for California form FTB 3805V.

Penalty Assessed by Professional Sports League – An owner of all or part of a professional sports franchise will not be allowed a deduction for the amount of any fine or penalty paid or incurred, that was assessed or imposed by the professional sports league that includes that franchise. Additional information can be found in the instructions for California Schedule CA (540NR).

Mandatory Electronic Payments – You are required to remit all your payments electronically once you make an estimate or extension payment exceeding $20,000 or you file an original tax return with a total tax liability over $80,000. Once you meet this threshold, all subsequent payments regardless of amount, tax type, or taxable year must be remitted electronically. The first payment that would trigger the mandatory e-pay requirement does not have to be made electronically. Individuals who do not send the payment electronically may be subject to a 1% noncompliance penalty.

You can request a waiver from mandatory e-pay if one or more of the following is true:

- You have not made an estimated tax or extension payment in excess of $20,000 during the current or previous taxable year.

- Your total tax liability reported for the previous taxable year did not exceed $80,000.

- The amount you paid is not representative of your total tax liability.

For more information or to obtain the waiver form, go to ftb.ca.gov/e-pay. Electronic payments can be made using Web Pay on FTB’s website, EFW as part of the e-file tax return, or your credit card.

Estimated Tax Payments – Taxpayers are required to pay 30% of the required annual payment for the 1st required installment, 40% of the required annual payment for the 2nd required installment, no installment is due for the 3rd required installment, and 30% of the required annual payment for the 4th required installment.

Taxpayers with a tax liability less than $500 ($250 for married/RDP filing separately) do not need to make estimated tax payments.

Backup Withholding – With certain limited exceptions, payers that are required to withhold and remit backup withholding to the IRS are also required to withhold and remit to the FTB on income sourced to California. If the payee has backup withholding, the payee must contact the FTB to provide a valid taxpayer identification number, before filing the tax return. Failure to provide a valid taxpayer identification number may result in a denial of the backup withholding credit. For more information, go to ftb.ca.gov and search for backup withholding.

Registered Domestic Partners (RDP) – Under California law, RDPs must file their California income tax return using either the married/RDP filing jointly or married/RDP filing separately filing status. RDPs have the same legal benefits, protections, and responsibilities as married couples unless otherwise specified.

If you entered into a same sex legal union in another state, other than a marriage, and that union has been determined to be substantially equivalent to a California registered domestic partnership, you are required to file a California income tax return using either the married/RDP filing jointly or married/RDP filing separately filing status.

For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified. When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737.

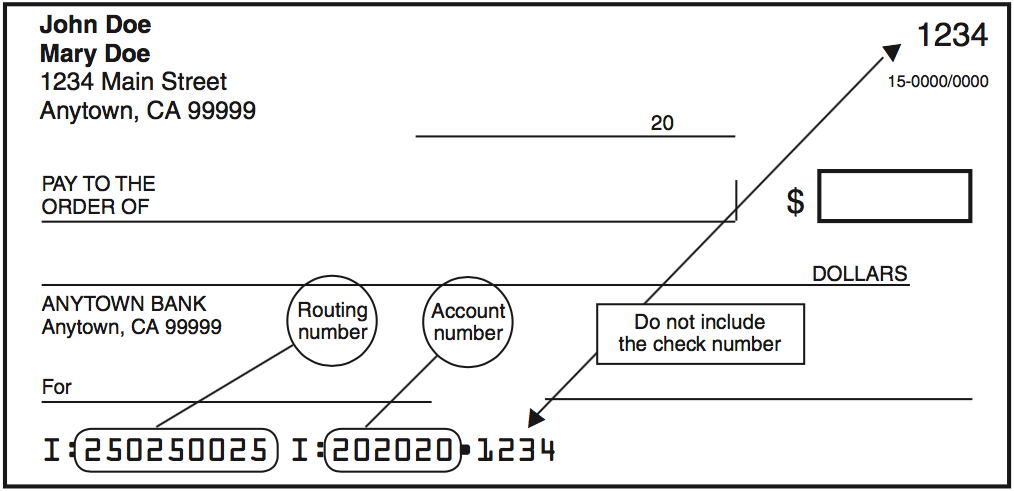

Direct Deposit Refund – You can request a direct deposit refund on your tax return whether you e-file or file a paper tax return. Be sure to fill in the routing and account numbers carefully and double-check the numbers for accuracy to avoid it being rejected by your bank.

Direct Deposit for ScholarShare 529 College Savings Plans – If you have a ScholarShare 529 College Savings Plan account maintained by the ScholarShare Investment Board, you may have your refund directly deposited to your ScholarShare account. Go to scholarshare529.com for instructions.

Group Nonresident Returns (also known as Composite Returns) – For taxable years beginning on or after January 1, 2009:

- Group nonresident returns may include less than two nonresident individuals.

- Nonresident individuals with more than $1,000,000 of California taxable income are eligible to be included in group nonresident returns. An additional 1% tax will be assessed on their entire California taxable income if they elect to be part of the group return.

See FTB Pub. 1067, Guidelines for Filing a Group Form 540NR, for more information.

California Disclosure Obligations – If the individual was involved in a reportable transaction, including a listed transaction, the individual may have a disclosure requirement. Attach federal Form 8886, Reportable Transaction Disclosure Statement, to the back of the California tax return along with any other supporting schedules. If this is the first time the reportable transaction is disclosed on the tax return, send a duplicate copy of the federal Form 8886 to the address below. The FTB may impose penalties if the individual fails to file federal Form 8886 or fails to provide any other required information. A material advisor is required to provide a reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material advisor.

Mail Tax Shelter Filing

ABS 389 MS F340

Franchise Tax Board

PO Box 1673

Rancho Cordova, CA 95812-9900

For more information, go to ftb.ca.gov and search for disclosure obligation.

How Nonresidents and Part-Year Residents Are Taxed

General Information

Nonresidents of California who received California sourced income in 2021, or moved into or out of California in 2021, file Form 540NR. California taxes all income received while you resided in California and the income you received from California sources while a nonresident.

If you file Form 540NR, use Schedule CA (540NR) column A through column D to compute your total adjusted gross income as if you were a resident of California for the entire year. Use column E to compute all items of total adjusted gross income you received while a resident of California and those you received from California sources while a nonresident. You determine your California tax by multiplying your California taxable income by an effective tax rate. The effective tax rate is the tax on total taxable income, taken from the tax table, divided by total taxable income. You may also qualify for California tax credits, which reduces the amount of California tax you owe.

If you were a resident of California for all of 2021, get a California Resident Personal Income Tax Booklet and file Form 540 or Form 540 2EZ.

For more information on the taxation of nonresidents and part-year residents, get FTB Pub. 1100, Taxation of Nonresidents and Individuals Who Change Residency. Go to ftb.ca.gov/forms or see “Where To Get Income Tax Forms and Publications.”

Pension Income of Retirees Who Move to Another State

Nonresidents of California Receiving a California Pension

California does not impose tax on retirement income attributable to services performed in California received by a nonresident after December 31, 1995.

California Residents Receiving an Out-of-State Pension

In general California residents are taxed on all income, including income from sources outside California. Therefore, a pension attributable to services performed outside California but received after you become a California resident is taxable.

For more information about pensions, go to ftb.ca.gov/forms and get FTB Pub. 1005, Pension and Annuity Guidelines.

Temporary and Transitory Absences from California

If you are domiciled in California and you worked outside of California for an uninterrupted period of at least 546 consecutive days under an employment contract, you are considered a nonresident. This provision also applies to the spouse/RDP who accompanies the employed individual during those 546 consecutive days. However, you will not qualify under this provision if you are present in California for a total of more than 45 days during any taxable year covered by the contract, or if you have income from stocks, bonds, notes, or other intangible property in excess of $200,000 for any taxable year covered by the contract. For more information, go to ftb.ca.gov/forms and get FTB Pub. 1031.

Group Nonresident Return

Nonresident partners, nonresident members, and nonresident shareholders of a partnership, limited liability company, or S corporation that does business in California or has income from California sources may elect to file a group nonresident return on Form 540NR. For more information, go to ftb.ca.gov/forms and get FTB Pub. 1067, Guidelines for Filing a Group Form 540NR. This publication includes form FTB 1067A, Nonresident Group Return Schedule, which must be attached to the group Form 540NR.

Military Servicemembers

Active duty military servicemembers go to ftb.ca.gov/forms and get FTB Pub. 1032.

Servicemembers domiciled outside of California, and their spouses/RDPs, exclude the member’s military compensation from gross income when computing the tax rate on nonmilitary income. Requirements for military servicemembers domiciled in California remain unchanged. Military servicemembers domiciled in California must include their military pay in total income. In addition, they must include their military pay in California source income when stationed in California. However, military pay is not California source income when a servicemember is permanently stationed outside of California. Beginning 2009, the federal Military Spouses Residency Relief Act may affect the California income tax filing requirements for spouses of military personnel.

2021 Instructions for Form 540NR California Nonresident or Part-Year Resident Income Tax Return

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC).

Before You Begin

Complete your federal income tax return (Form 1040, U.S. Individual Income Tax Return; Form 1040-SR, U.S. Tax Return for Seniors; or Form 1040-NR, U.S. Nonresident Alien Income Tax Return) before you begin your Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. Use information from your federal income tax return to complete your Form 540NR. Complete and mail Form 540NR by April 18, 2022. If unable to mail your return by this date, see Important Dates.

To get forms and publications referred to in these instructions, go to ftb.ca.gov/forms or see “Where To Get Income Tax Forms and Publications.”

Tip: You may qualify for the federal earned income tax credit. See Earned Income Tax Credit for more information.

Note: The lines on Form 540NR are numbered with gaps in the line number sequence. For example, lines 20 through 30 do not appear on Form 540NR, so the line number that follows line 19 on Form 540NR is line 31.

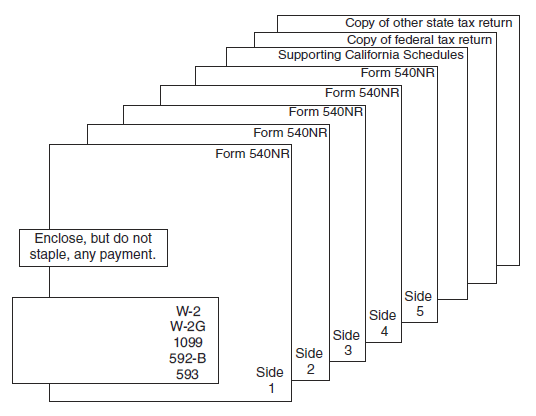

Caution: Form 540NR has five sides. If filing Form 540NR, you must send all five sides to the Franchise Tax Board (FTB).

If you need to amend your Form 540NR, complete an amended Form 540NR and check the box at the top of Form 540NR indicating AMENDED return. Attach Schedule X, California Explanation of Amended Return Changes, to the amended Form 540NR. For specific instructions, see “Instructions for Filing a 2021 Amended Return.”

Filling in Your Return

- Use black or blue ink on the tax return you send to the FTB.

- Enter your Social Security Number(s) or Individual Taxpayer Identification Number(s) at the top of Form 540NR, Side 1.

- Print numbers and CAPITAL LETTERS in the space provided. Be sure to line up dollar amounts.

- If you do not have an entry for a line, leave it blank unless the instructions for a line specifically tell you to enter zero. Do not enter a dash or the word “NONE.”

Name(s) and Address

Print your first name, middle initial, last name, and street address in the spaces provided at the top of Form 540NR.

Suffix

Use the Suffix field for generational name suffixes such as “SR”, “JR”, “III”, “IV”. Do not enter academic, professional, or honorary suffixes.

Additional Information

Use the Additional Information field for “In-Care-of” name and other supplemental address information only.

Foreign Address

If you have a foreign address, follow the country’s practice for entering the city, county, province, state, country, and postal code, as applicable, in the appropriate boxes. Do not abbreviate the country name.

Principal Business Activity (PBA) Code

For federal Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) business filers, enter the numeric PBA code from federal Schedule C (Form 1040), line B.

Date of Birth (DOB)

Enter your DOBs (mm/dd/yyyy) in the spaces provided. If your filing status is married/RDP filing jointly or married/RDP filing separately, enter the DOBs in the same order as the names.

Prior Name

If you or your spouse/RDP filed your 2020 tax return under a different last name, write the last name only from the 2020 tax return.

Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

Enter your SSNs in the spaces provided. If you file a joint tax return, enter the SSNs in the same order as the names.

If you do not have an SSN because you are a nonresident or a resident alien for federal tax purposes, and the Internal Revenue Service (IRS) issued you an ITIN, enter the ITIN in the space provided for the SSN.

An ITIN is a tax processing number issued by the IRS to foreign nationals and others who have a federal tax filing requirement and do not qualify for an SSN. It is a nine-digit number that always starts with the number 9.

Filing Status

Line 1 through Line 5 – Filing Status

Check only one box for line 1 through line 5. Enter the required additional information if you checked the box on line 3 or line 5. See filing status requirements.

Usually, your California filing status must be the same as the filing status you used on your federal income tax return.

Exception for Married Taxpayers Who File a Joint Federal Income Tax Return – You may file separate California returns if either spouse was either of the following:

- An active member of the United States Armed Forces or any auxiliary military branch during 2021.

- A nonresident for the entire year and had no income from California sources during 2021. Caution – Community Property States: If either spouse earned California source income while domiciled in a community property state, the community income will be split equally between the spouses. Both spouses will have California source income and they will not qualify for the nonresident spouse exception. For more information, get FTB Pub. 1031, Guidelines for Determining Resident Status.

If you had no federal filing requirement, use the same filing status for California you would have used to file a federal income tax return.

Registered domestic partners (RDPs) who file single for federal must file married/RDP filing jointly or married/RDP filing separately for California. If you are an RDP and file head of household for federal purposes, you may file head of household for California purposes only if you meet the requirements to be considered unmarried or considered not in a domestic partnership.

Nonresident Alien – A joint tax return may be filed if, in the case of a nonresident alien married to a United States citizen or resident, both spouses/RDPs elect to treat the nonresident alien spouse/RDP as a resident for tax purposes.

If You Filed Federal Form 1040-NR, you do not qualify to use the head of household or married/RDP filing jointly filing statuses. Instead, use single, married/RDP filing separately, or qualifying widow(er) filing status, whichever applies to you.

If You File as Head of Household, do not claim yourself or a nonrelative as the qualifying individual for head of household. Get FTB Pub. 1540, Tax Information for Head of Household Filing Status, for more information. See “Where To Get Income Tax Forms and Publications.”

Exemptions

Line 6 – Can be Claimed as a Dependent

Check the box on line 6 if someone else can claim you or your spouse/RDP as a dependent on their tax return, even if they choose not to.

Line 7 – Personal Exemptions

Did you check the box on line 6?

- Single or married/RDP filing separately, enter -0-.

- Head of household, enter -0-.

- Married/RDP filing jointly and both you and your spouse/RDP can be claimed as dependents, enter -0-.

- Married/RDP filing jointly and only one spouse/RDP can be claimed as a dependent, enter 1.

Do not claim this credit if someone else can claim you as a dependent on their tax return.

Line 8 – Blind Exemptions

The first year you claim this exemption credit, attach a doctor’s statement to the back of Form 540NR indicating you or your spouse/RDP is visually impaired. If you e-file, attach any requested forms, schedules and documents according to your software’s instructions. Visually impaired means not capable of seeing better than 20/200 while wearing glasses or contact lenses, or if your field of vision is not more than 20 degrees.

Do not claim this credit if someone else can claim you as a dependent on their tax return.

Line 9 – Senior Exemptions

If you were 65 years of age or older by December 31, 2021*, you should claim an additional exemption credit on line 9. If you are married/or an RDP, each spouse/RDP 65 years of age or older should claim an additional credit. You may contribute all or part of this credit to the California Seniors Special Fund. See “Voluntary Contribution Fund Descriptions” for more information.

*If your 65th birthday is on January 1, 2022, you are considered to be age 65 on December 31, 2021.

Do not claim this credit if someone else can claim you as a dependent on their tax return.

Line 10 – Dependent Exemptions

To claim an exemption credit for each of your dependents, you must write each dependent’s first and last name, SSN or ITIN and relationship to you in the space provided. If you are claiming more than three dependents, attach a statement with the required dependent information to your tax return. The persons you list as dependents must be the same persons you listed as dependents on your federal income tax return. If you filed form FTB 3568, Alternative Identifying Information for the Dependent Exemption Credit, to qualify to claim your dependents for California purposes, the dependents you claim on your California income tax return may not match those claimed on your federal income tax return. Count the number of dependents listed and enter the total in the box on line 10. Multiply the number you entered by the pre‑printed dollar amount and enter the result.

For taxable years beginning on or after January 1, 2018, taxpayers claiming a dependent exemption credit for a dependent who is ineligible for an SSN or a federal ITIN may provide alternative information to the FTB to identify the dependent.

To claim the dependent exemption credit, taxpayers complete form FTB 3568, attach the form and required documentation to their tax return, and write “no id” in the SSN field of line 10, Dependents, on Form 540NR. For each dependent being claimed that does not have an SSN and an ITIN, a form FTB 3568 must be provided along with supporting documentation. If you e-file, attach any requested forms, schedules and documents according to your software’s instructions.

Taxpayers may amend their tax returns beginning with taxable year 2018 to claim the dependent exemption credit. These taxpayers should complete an amended Form 540NR, write “no id” in the SSN field on the Dependents line, and attach Schedule X. To complete Schedule X, check box m for “Other” on Part II, line 1, and write the explanation “Claim dependent exemption credit with no id and form FTB 3568 is attached” on Part II, line 2. Make sure to attach form FTB 3568 and the required supporting documents in addition to the amended tax return and Schedule X. If taxpayers do not claim the dependent exemption credit on their original 2021 tax return, they may amend their 2021 tax return following the same procedures used to amend their previous year amended tax returns beginning with taxable year 2018. For more information, get FTB Notice 2021-01.

If your dependent child was born and died in 2021 and you do not have an SSN or an ITIN for the child, write “Died” in the space provided for the SSN and include a copy of the child’s birth certificate, death certificate, or hospital records. The document must show the child was born alive. If you e-file, attach any requested forms, schedules and documents according to your software’s instructions.

Line 11 – Exemption Amount

Add line 7 through line 10 and enter the total dollar amount of all exemptions for personal, blind, senior, and dependent.

Total Taxable Income

Refer to your completed federal income tax return to complete this section.

Line 12 – California Wages

Enter the total amount of your California wages from your federal Form(s) W‑2, Wage and Tax Statement. This amount appears on Form W-2, box 16.

Line 13 – Federal Adjusted Gross Income (AGI) from federal Form 1040, 1040-SR, or 1040-NR, line 11

RDPs who file a California tax return as married/RDP filing jointly and have no RDP adjustments between federal and California, combine their individual AGIs from their federal tax returns filed with the IRS. Enter the combined AGI on Form 540NR, line 13.

RDP adjustments include but are not limited to the following:

- Transfer of property between spouses/RDPs

- Capital loss

- Transactions between spouses/RDPs

- Sale of residence

- Dependent care assistance

- Investment interest

- Qualified residence interest acquisition loan & equity loan

- Expense depreciation property limits

- Individual Retirement Account

- Interest education loan

- Rental real estate passive loss

- Rollover of publicly traded securities gain into specialized small business investment companies

RDPs filing as married/RDP filing separately, former RDPs filing single, and RDPs with RDP adjustments will use the California RDP Adjustments Worksheet in FTB Pub. 737, Tax Information for Registered Domestic Partners, or complete a federal pro forma Form 1040 or 1040-SR. Transfer the amount from the California RDP Adjustments Worksheet, line 27, column D, or federal pro forma Form 1040 or 1040-SR, line 11, to Form 540NR, line 13.

Line 14 – California Adjustments – Subtractions (from Schedule CA (540NR), Part II, line 27, column B)

If there are differences between your federal and California income, i.e. social security, complete Schedule CA (540NR). Follow the instructions for Schedule CA (540NR). Enter the amount from Schedule CA (540NR), Part II, line 27, column B on Form 540NR, line 14.

If the amount on Schedule CA (540NR), Part II, line 27, column B is a negative number, do not transfer it to Form 540NR, line 14 as a negative number. Instead, transfer the number as a positive number to Form 540NR, line 16.

Line 15 – Subtotal

Subtract the amount on line 14 from the amount on line 13. Enter the result on line 15. If the amount on line 13 is less than zero, combine the amounts on line 13 and line 14 and enter the amount in parentheses. For example: “(12,325).”

Line 16 – California Adjustments – Additions (from Schedule CA (540NR), Part II, line 27, column C)

If there are differences between your federal and California deductions, complete Schedule CA (540NR). Follow the instructions for Schedule CA (540NR). Enter the amount from Schedule CA (540NR), Part II, line 27, column C on Form 540NR, line 16.

If the amount on Schedule CA (540NR), Part II, line 27, column C is a negative number, do not transfer it to Form 540NR, line 16 as a negative number. Instead, transfer the number as a positive number to Form 540NR, line 14.

Line 17 – Adjusted Gross Income From All Sources

Combine line 15 and line 16. This amount should match the amount on Schedule CA (540NR), Part II, line 27, column D.

Line 18 – California Itemized Deductions or California Standard Deduction

Decide whether to itemize your deductions, such as charitable contributions, medical expenses, etc., or take the standard deduction. Your California income tax will be less if you take the larger of your California:

- Itemized deductions (total itemized deductions allowed under California law).

- Standard deduction.

On federal tax returns, individual taxpayers who claim the standard deduction are allowed an additional deduction for net disaster losses. For California, deductions for disaster losses are only allowed for those individual taxpayers who itemized their deductions.

If married/or an RDP and filing separate Form 540NR, you and your spouse/RDP must either both itemize your deductions (even if the itemized deductions of one spouse/RDP are less than the standard deduction) or both take the standard deduction.

Also, if someone else can claim you as a dependent, you may claim the greater of the standard deduction or your itemized deductions. To figure your standard deduction, see the California Standard Deduction Worksheet for Dependents.

Itemized Deductions – Figure your California itemized deductions by completing Schedule CA (540NR), Part III, lines 1 through 30. Enter the result on Form 540NR, line 18.

If you did not itemize deductions on your federal income tax return but will itemize deductions for your Form 540NR, first complete federal Schedule A (Form 1040), Itemized Deductions. Then check the box on Side 4, Part III of the Schedule CA (540NR), and complete Part III. Attach both the federal Schedule A (Form 1040) and California Schedule CA (540NR) to the back of your tax return.

Standard Deduction – Find your standard deduction on the California Standard Deduction Chart for Most People. If you checked the box on Form 540NR, line 6, use the California Standard Deduction Worksheet for Dependents, instead.

California Standard Deduction Chart for Most People

Do not use this chart if your parent, or someone else, can claim you (or your spouse/RDP) as a dependent on their tax return.

| Your Filing Status | Enter On Line 18 |

|---|---|

| 1 – Single | $4,803 |

| 2 – Married/RDP filing jointly | $9,606 |

| 3 – Married/RDP filing separately | $4,803 |

| 4 – Head of household | $9,606 |

| 5 – Qualifying widow(er) | $9,606 |

The California standard deduction amounts are less than the federal standard deduction amounts.

California Standard Deduction Worksheet for Dependents

Use this worksheet only if your parent, or someone else, can claim you (or your spouse/RDP) as a dependent on their return. Use whole dollars only.

- Enter your earned income from: line 2 of the “Standard Deduction Worksheet for Dependents’’ in the instructions for federal Form 1040 or 1040-SR.

- Minimum standard deduction: $1,100.00.

- Enter the larger of line 1 or line 2 here.

- Enter the amount shown for your filing status:

- Single or married/RDP filing separately, enter $4,803.

- Married/RDP filing jointly, head of household, or qualifying widow(er), enter $9,606.

- Standard deduction. Enter the smaller of line 3 or line 4 here and on Form 540NR, line 18.

Line 19 – Taxable Income

Capital Construction Fund (CCF) – If you claim a deduction on your federal Form 1040 or 1040-SR, line 15 for a contribution made to a CCF set up under the Merchant Marine Act of 1936, reduce the amount you would otherwise enter on line 19 by the amount of the deduction. Next to line 19, enter “CCF” and the amount of the deduction. For more information, get federal Publication 595, Capital Construction Fund for Commercial Fishermen.

California Taxable Income

When you figure your tax, use the correct filing status and taxable income amount.

Line 31 – Tax

Tip: e-file and you won’t have to do the math. Go to ftb.ca.gov and search for efile.

To figure your tax on the amount on line 19, use one of the following methods and check the matching box on line 31:

- Tax Table – If your taxable income on line 19 is $100,000 or less, use the tax table. Use the correct filing status column in the tax table.

- Tax Rate Schedules – If your taxable income on line 19 is over $100,000, use the tax rate schedule for your filing status.

- FTB 3800 – Generally, you use form FTB 3800, Tax Computation for Certain Children with Unearned Income, to figure the tax on a separate Form 540NR for your child who was age 18 and under or a student under age 24 on January 1, 2022, and who had more than $2,200 of investment income. Attach form FTB 3800 to the child’s Form 540NR.

- FTB 3803 – If, as a parent, you elect to report your child’s interest and dividend income of $11,000 or less (but not less than $1,100) on your return, complete form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends. File a separate form FTB 3803 for each child whose income you elect to include on your Form 540NR. Add the amount of tax, if any, from each form FTB 3803, line 9, to the amount of your tax from the tax table or tax rate schedules and enter the result on Form 540NR, line 31. Attach form(s) FTB 3803 to your return.

To prevent possible delays in processing your tax return or refund, enter the correct tax amount on this line. To automatically figure your tax or to verify your tax calculation, use our online tax calculator. Go to ftb.ca.gov/tax-rates.

Line 32 – CA Adjusted Gross Income

Complete Schedule CA (540NR), Part IV, line 1 to determine your California adjusted gross income. Follow the instructions for Schedule CA (540NR). Enter on Form 540NR, line 32 the amount from Schedule CA (540NR), Part IV, line 1.

Line 36 – CA Tax Rate

In this computation, the FTB rounds the tax rate to four digits after the decimal. If your computation is different, you may receive a notice due to the difference in rounding. Contact us at 800-852-5711 if you disagree with this notice.

Line 38 – CA Exemption Credit Percentage

Divide the California Taxable Income (line 35) by Total Taxable Income (line 19). This percentage does not apply to the Nonrefundable Renter’s Credit, Nonrefundable Child and Dependent Care Expenses Credit, Other State Tax Credit, or credits that are conditional upon a transaction occurring wholly within California. If more than 1, enter 1.0000.

Line 39 – CA Prorated Exemption Credits

Use your exemption credits to reduce your tax. If your federal AGI on line 13 is more than the amount listed below for your filing status, your credits will be limited.

| If your filing status is: | Is Form 540NR, line 13 more than: |

|---|---|

| Single or married/RDP filing separately | $212,288 |

| Married/RDP filing jointly or qualifying widow(er) | $424,581 |

| Head of household | $318,437 |

AGI Limitation Worksheet

Use whole dollars only.

- Enter the amount from Form 540NR, line 13.

- Enter the amount for your filing status on line b:

- Single or married/RDP filing separately: $212,288

- Married/RDP filing jointly or qualifying widow(er): $424,581

- Head of household: $318,437

- Subtract line b from line a.

- Divide line c by $2,500 ($1,250 if married/RDP filing separately). If the result is not a whole number, round it to the next higher whole number.

- Multiply line d by $6.

- Add the numbers from the boxes on Form 540NR, line 7, line 8, and line 9 (not the dollar amounts).

- Multiply line e by line f.

- Add the total dollar amounts from Form 540NR, line 7, line 8, and line 9.

- Subtract line g from line h. If zero or less, enter -0-.

- Enter the number from the box on Form 540NR, line 10 (not the dollar amount).

- Multiply line e by line j.

- Enter the dollar amount from Form 540NR, line 10.

- Subtract line k from line l. If zero or less, enter -0-.

- Add line i and line m. Enter the result here.

- Multiply the amount on line n by the CA Exemption Credit Percentage on Form 540NR, line 38. Enter the result here and on Form 540NR, line 39.

Line 41 – Tax from Schedule G-1 and Form FTB 5870A

If you received a qualified lump-sum distribution in 2021 and you were born before January 2, 1936, get California Schedule G-1, Tax on Lump-Sum Distributions, to figure your tax by special methods that may result in less tax. Attach Schedule G-1 to your tax return.

If you received accumulation distributions from foreign trusts or from certain domestic trusts, get form FTB 5870A, Tax on Accumulation Distribution of Trusts, to figure the additional tax. Attach form FTB 5870A to your tax return.

Special Credits and Nonrefundable Credits

A variety of California tax credits are available to reduce your tax if you qualify. To figure and claim most special credits, you must complete a separate form or schedule and attach it to your Form 540NR. The Credit Chart describes the credits and provides the name, credit code, and number of the required form or schedule. Many credits are limited to a certain percentage or a certain dollar amount. In addition, the total amount you may claim for all credits is limited by tentative minimum tax (TMT); go to Box A to see if your credits are limited.

If you are not claiming any other special credits go to line 50 and line 61 to see if you qualify for the Nonrefundable Child and Dependent Care Expenses Credit or the Nonrefundable Renter’s Credit.

Box A

Did you complete federal Schedule C, D, E, or F and claim or receive any of the following (Note: If your business gross receipts are less than $1,000,000 from all trades or businesses, you do not have to report alternative minimum tax (AMT). For more information, see line 71 instructions.):

- Accelerated depreciation in excess of straight-line

- Intangible drilling costs

- Depletion

- Circulation expenditures

- Research and experimental expenditures

- Mining exploration/development costs

- Amortization of pollution control facilities

- Income/loss from tax shelter farm activities

- Income/loss from passive activities

- Income from long-term contracts using the percentage of completion method

- Pass-through AMT adjustment from an estate or trust reported on Schedule K-1 (541)

Box B

Did you claim or receive any of the following:

- Investment interest expense

- Income from incentive stock options in excess of the amount reported on your return

- Income from installment sales of certain property

Box C

| If your filing status is: | Is Form 540NR, line 17 more than: |

|---|---|

| Single or head of household | $292,763 |

| Married/RDP filing jointly or qualifying widow(er) | $390,351 |

| Married/RDP filing separately | $195,172 |

Yes Get and complete Schedule P (540NR). See “Order Forms and Publications.” No Your credits are not limited.

Line 50 – Nonrefundable Child and Dependent Care Expenses Credit – Code 232

Claim this credit if you paid someone to care for your qualifying child under the age of 13, other dependent who is physically or mentally incapable of caring for him or herself, or spouse/RDP if physically or mentally incapable of caring for him or herself. To claim this credit, your federal AGI must be $100,000 or less. Complete and attach form FTB 3506, Child and Dependent Care Expenses Credit. See “Where To Get Income Tax Forms and Publications.”

The care must have been provided in California. You must have California-sourced income (wages earned working in California or self‑employment income from California business activities).

A servicemember’s active duty military pay is considered earned income, regardless of whether the servicemember is domiciled in California. Get FTB Pub. 1032, Tax Information for Military Personnel, for more information.

Schedule P (540NR) – If you need to complete Schedule P (540NR) and you claim any of the credits on line 51 through line 53, do not enter an amount on line 51 through line 53. Instead, enter the total amount of these credits from Schedule P (540NR), Part III, Section B1, line 12 through line 14, on Form 540NR, line 55. Do not follow the instructions for line 55. Write “Schedule P (540NR)” to the left of the amount entered on line 55.

Line 51 – Credit for Joint Custody Head of Household – Code 170

You may not claim this credit if you used the head of household, married/RDP filing jointly, or the qualifying widow(er) filing status.

Claim the credit if unmarried and not an RDP at the end of 2021 (or if married/or an RDP, you lived apart from your spouse/RDP for all of 2021 and you used the married/RDP filing separately filing status); and if you furnished more than one-half the household expenses for your home that also served as the main home of your child, step-child, or grandchild for at least 146 days but not more than 219 days of your taxable year. If the child is married/or an RDP, you must be entitled to claim a dependent exemption for the child.

Also, the custody arrangement for the child must be part of a decree of dissolution or legal separation or part of a written agreement between the parents where the proceedings have been initiated, but a decree of dissolution or legal separation has not yet been issued.

If your Federal AGI is more than $212,288, subtract line n from the AGI Limitation Worksheet from line 31 of the Form 540NR and enter this amount on line 1 of the worksheet below to calculate your credit.

Use the worksheet below to figure this credit using whole dollars only:

- Subtract line 11 from line 31 on Form 540NR and enter the result here.

- Enter the amount from Form 540NR, line 41.

- Add line 1 and line 2.

- Credit percentage – 30%: .30

- Credit amount. Multiply line 3 by line 4. Enter on this line the result or $513, whichever is less. Enter this amount on Form 540NR, line 51.

If you qualify for both the Credit for Joint Custody Head of Household and the Credit for Dependent Parent, you are only allowed to claim one or the other, not both. Select the credit that will allow the maximum benefit.

Line 52 – Credit for Dependent Parent – Code 173

You may not claim this credit if you used the single, head of household, qualifying widow(er), or married/RDP filing jointly filing status.

Claim this credit only if all of the following apply:

- You were married/or an RDP at the end of 2021 and you used the married/RDP filing separately filing status.

- Your spouse/RDP was not a member of your household during the last six months of the year.

- You furnished over one-half the household expenses for your dependent mother’s or father’s home, whether or not she or he lived in your home.

To figure the amount of this credit, use the worksheet for the Credit for Joint Custody Head of Household.

On the last line of the worksheet, enter the result or $513, whichever is less. Enter this amount on Form 540NR, line 52.

If you qualify for both the Credit for Joint Custody Head of Household and the Credit for Dependent Parent, you are only allowed to claim one or the other, not both. Select the credit that will allow the maximum benefit.

Line 53 – Credit for Senior Head of Household – Code 163

Claim this credit if you:

- Were 65 years of age or older on December 31, 2021*.

- Qualified as a head of household in 2019 or 2020 by providing a household for a qualifying individual who died during 2019 or 2020.

- Did not have adjusted gross income over $83,039 for 2021.

*If your 65th birthday is on January 1, 2022, you are considered to be age 65 on December 31, 2021.

If you meet all the conditions listed, you do not need to qualify to use the head of household filing status for 2021 in order to claim this credit.

Use the worksheet below to figure this credit using whole dollars only:

- Enter the amount from Form 540NR, line 19.

- Credit percentage – 2%: .02

- Credit amount. Multiply line 1 by line 2. Enter on this line the result or $1,565, whichever is less. Enter this amount on Form 540NR, line 53.

Line 54 and Line 55 – Credit Percentage and Credit Amount

If you claimed credits on line 51, line 52, or line 53, complete the worksheet below to compute your credit percentage and the allowable prorated credit to enter on line 55 using whole dollars only. If you completed Schedule P (540NR), see the instructions above the line 51 instructions.

Part I – Credit Percentage

- Enter the percentage amount from line 38 here and on Form 540NR, line 54. If more than 1, enter 1.0000.

Part II – Credit Amount

Credit for Joint Custody Head of Household

- Enter the amount from Form 540NR, line 51.

- Credit Percentage from Part I, line 1.

- Multiply line 1 by line 2.

- Enter the lesser of the amount from line 3 or $513.

Credit for Dependent Parent

- Enter the amount from Form 540NR, line 52.

- Credit Percentage from Part I, line 1.

- Multiply line 5 by line 6.

- Enter the lesser of the amount on line 7 or $513.

Credit for Senior Head of Household

- Enter the amount from Form 540NR, line 53.

- Credit Percentage from Part I, line 1.

- Multiply line 9 by line 10.

- Enter the lesser of the amount on line 11 or $1,565.

Total Prorated Credits

- Add line 4, line 8, and line 12. Enter the result here and on Form 540NR, line 55.

Line 58 through Line 60 – Additional Special Credits

A code identifies each credit. To claim only one or two credits, enter the credit name, code, and amount of the credit on line 58 and line 59.

To claim more than two credits, use Schedule P (540NR), Part III. Get Schedule P (540NR) instructions, “How to Claim Your Credits.”

Important: Attach Schedule P (540NR) and any required supporting schedules or statements to your Form 540NR.

Carryovers: If you claim a credit with carryover provisions and the amount of the credit available this year exceeds your tax, carry over any excess credit to future years until the credit is used (unless the carryover period is a fixed number of years). If you claim a credit carryover for an expired credit, use form FTB 3540, Credit Carryover and Recapture Summary, to figure the amount of the credit.

Credit for Child Adoption Costs – Code 197

For the year in which an adoption decree or an order of adoption is entered (e.g. adoption is final), claim a credit for 50% of the cost of adopting a child who was both:

- A citizen or legal resident of the United States

- In the custody of a California public agency or a California political subdivision

Treat a prior unsuccessful attempt to adopt a child (even when the costs were incurred in a prior year) and a later successful adoption of a different child as one effort when computing the cost of adopting the child. Include the following costs if directly related to the adoption process:

- Fees for Department of Social Services or a licensed adoption agency

- Medical expenses not reimbursed by insurance

- Travel expenses for the adoptive family

Note:

- This credit does not apply when a child is adopted from another country or another state, or who was not in the custody of a California public agency or a California political subdivision.

- Any deduction for the expenses used to claim this credit must be reduced by the amount of the child adoption costs credit claimed.

Use the following worksheet to figure this credit using whole dollars only. If more than one adoption qualifies for this credit, complete a separate worksheet for each adoption. The maximum credit is limited to $2,500 per minor child.

- Enter qualifying costs for the child.

- Credit percentage – 50%: .50

- Credit amount. Multiply line 1 by line 2. Do not enter more than $2,500.